One of the main questions we get asked is how much it costs to live this live aboard and cruising lifestyle, especially on a powerboat, motor yacht, or trawler. Well, we’ve been tracking our expenses for two full years now, and we are going to break it all down for you here. We will even dive into our boat maintenance including repairs from our Hope Town accident and the blown head gasket. This may be a shocker for some of you.

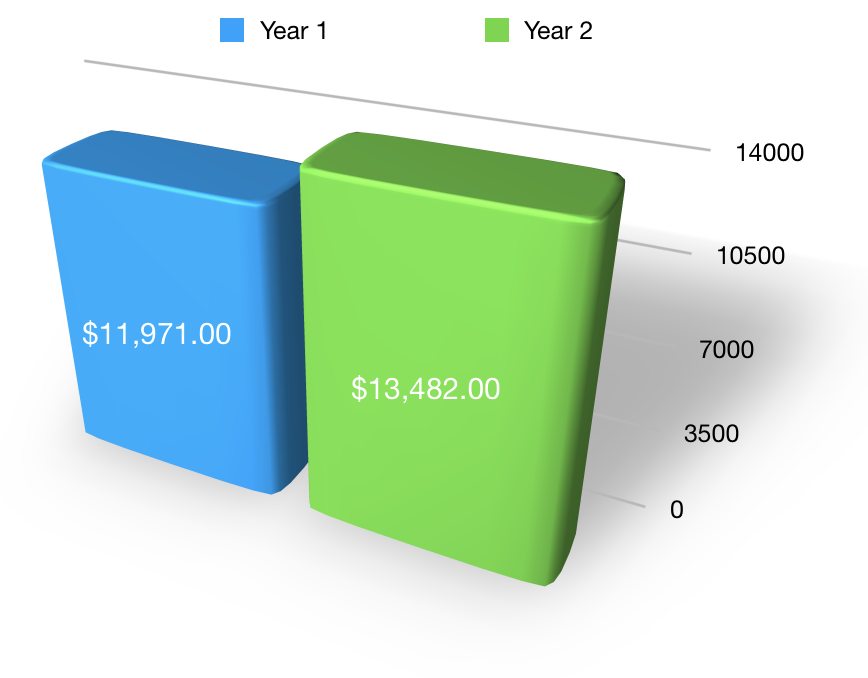

Before we dive in, let’s total it all up to compare the total boat and cruising related expenses for the two years. As you can see, if we were to look at this monthly, that would be $6426.00 per month in year one, and $4468.00 per month in year two.

Disclaimer, this isn’t everything we spent in those two years. This is cruising and living aboard related expenses. We had other personal expenses that we don’t feel are of value to share, things like donations, life insurance, etc. This should be decent news for most people wondering what their monthly expenses would be, we’ve had so many people ask if they could do it on $5000 a month. Given these numbers we’d say that is a YES, that is certainly possible!

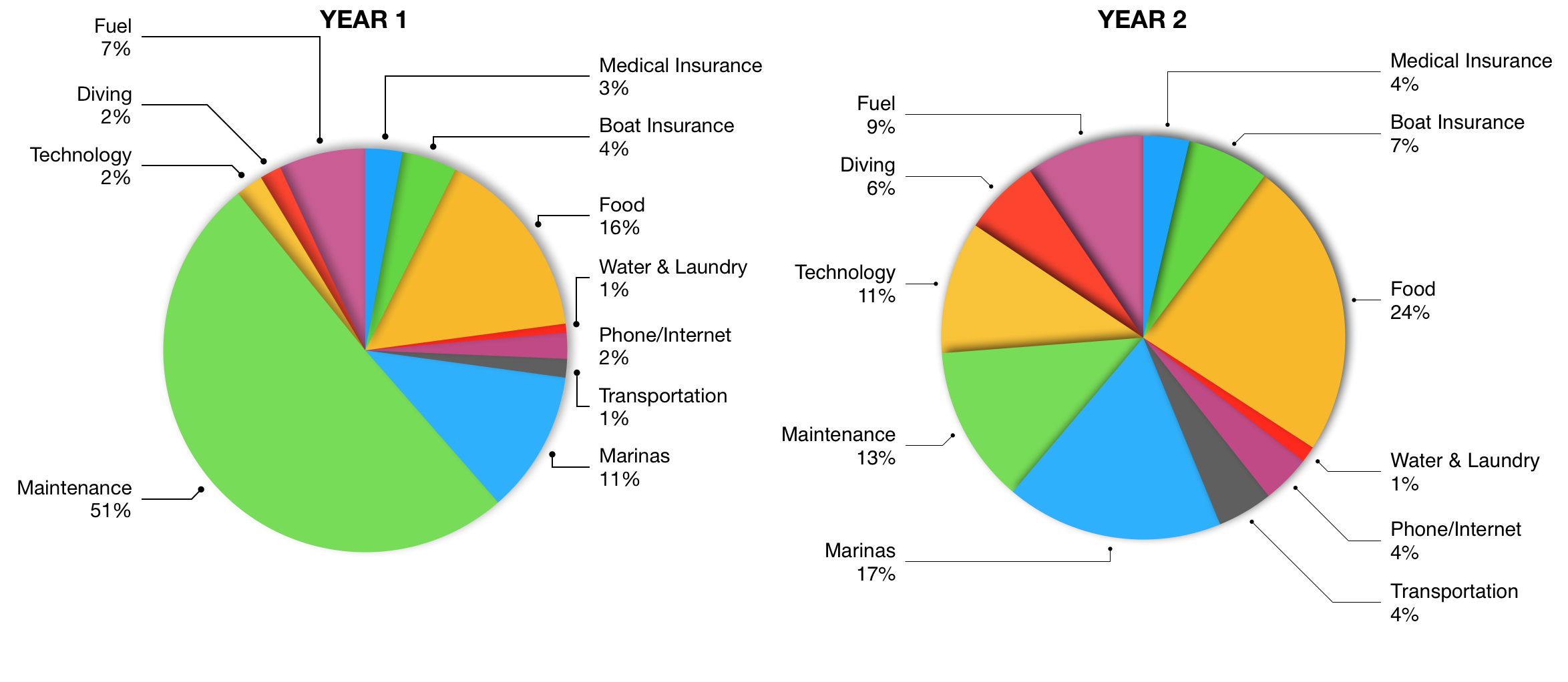

Take a look at how our expenses are dispersed. We can talk percentages here as we think it will be more applicable to apply to your budget.

Let’s get into the specifics. We’ve released two companion videos on this topic, and it’s a good idea to give them a watch before proceeding through the section they are posted in.

Medical Insurance

Our medical insurance is going to apply more closely to Canadians than it is Americans or anyone else in other parts of the world. We are currently under our Canadian Ontario Health Insurance Plan (OHIP). When we travel out of the country, we add travel medical insurance. The insurance companies give us a much lower premium when we have the backing of our Canadian health plan. We use The Co-operators which averages about $6.25 CDN per day for the two of us together.

OHIP allows you to be out of the Country for 7 months a year and still be covered. It also has a benefit that allows you to be away for 2 full years every 5. This is something not everyone knows to take advantage of in Ontario. However, if you require to be out of the province more than this, you would need to get Expat insurance which would cost much more than travel insurance with a valid OHIP. Expat insurance could be a future option for us, as the cost to travel back to Canada each year vs the cost of expat insurance may be about the same. For anyone who lets their provincial healthcare expire, it would only take 3 months to reinstate it once you return. Please note each province in Canada has different requirements, so please check your provincial plan for specifics.

How does this compare to land-based living?

Since we are under OHIP, which is government-provided health care, any extra cost we have is something we wouldn’t have while living in Canada on land.

Water & Laundry

As mentioned in the video we don’t have a Water Maker, so when in the Bahamas we have to pay for water. We hold 150 gallons of water and we can push that to 3 weeks if we need to. There are places to get free Reverse Osmosis water in the Bahamas, but they are usually not a place that will allow the boat to dock and fill up. We carry water containers for these free places and maybe fill these up and dump into the tank. We can extend our water for 3-4 days doing this.

There is not too much we can say about laundry. It is what it is. We pay for it in the US and in the Bahamas. The average cost to do laundry in the US is about $1.50-$2.00 for a wash or dry, and in The Bahamas it is about $3.00-$5.00 for a wash or dry. So 1 load of laundry in The Bahamas is about $10. One tip though, if you are in the Exumas, and you need to stay at a marina for a little bit, Emerald Bay Marina on Great Exuma has free laundry for those staying at the marina.

How does this compare to land-based living?

It is reported that Canada’s average household water bill is around $33 per month. That’s pretty cheap compared to most of the world. So in this category, water is much more expensive than land-based living. At least in Canada.

Food & Groceries

The prices for groceries include anything from laundry detergent, sunblock, paper towels, etc. Essentially anything that can be bought at a grocery store is included in these numbers.

How does this compare to land-based living?

This averages about $1000 per month in Food and Groceries. If we remember correctly that is about what we spent in our land-based life. We buy and eat the same things, eat out the same amount. So we guess this one is about equal, for us anyway.

Fuel

As mentioned in the video, year one we travelled from Ontario Canada to The Bahamas, cruised The Bahamas for 6 months, then headed back to Florida. Year two we travelled from Florida to The Bahamas, cruised The Bahamas for 8 months, then back to Florida.

How does this compare to land-based living?

The only thing to compare this to, from a land-based living perspective, is a car. When we lived in a house we had at least one car, sometimes two. With the one car, fuel for the year would be $3500, which included a lot of commuting to work. We think that is pretty comparable. If you add in the cost of maintenance on the car and insurance, well the car becomes way more expensive than the fuel for the boat. Even if you add in the Dinghy cost and maintenance (as if it was our car), land-based live is still much more expensive.

We do wonder though, what pollutes more, a boat with Diesel engines scooting around the Bahamas, or a car used for committing to work and traveling? If anyone has an opinion on this please comment below.

Phone and Connectivity

Staying connected while cruising is very important to us. We work remotely while in the Bahamas, and a day with a loss of connection is money lost. It is one of the main reasons we have not ventured south of George Town Exumas. We are afraid of getting stuck without a connection in those southern remote islands. We even wonder what connectivity would be like in the rest of the Caribbean? Being without a connection will be detrimental to our ability to do this lifestyle long term.

What Services We Use:

magicJack gives us a Canadian phone # for family and friends in Canada to reach us without long-distance charges. We have the app on our phone that we use for calling. We can even plug a real landline type cordless phone into the small device connected to our router and it behaves like a landline. The cost per year is $55 CDN.

T-Mobile is who we use when in the US and Canada which provides us with unlimited calling to US/CDN and unlimited data. They claim they may throttle you with heavy data usage, however, we are heavy users and we have rarely noticed any degradation in speed. We use the hotspot on the phone for our internet. The cost per month is $100. When we go to The Bahamas we suspend our plan which costs $9.99 per month. A quick call to T-Mobile when we return to the US has us back online.

While in The Bahamas, we have used all of the below and all are reliable and reasonably priced options.

My Island Wifi is a relatively new service in the Bahamas. It provides an economical way to get unlimited unthrottled data while in the Bahamas. A rental plan of $75 per month for unlimited data. There is a $50 deposit fee and a $10 delivery fee. The $50 is refunded once you give back the device. They have a very personal service and are happy to help you out to get all setup. This has become our go-to service for data when in the Bahamas. Check them out at My Island Wifi at https://myislandwifi.com

BTC has been around the longest, and the data plans use to be the most expensive. However, with competition increasing from Aliv, you can now get good prices on data. For the cost of $29.99, you will get 15 GB of data and 1000 min of calling to US/CAN for 15 days. You can easily top up if you run out of data. We go over the 15GB way before the 15 days and just top up when needed. The average cost for us to use this service when not having My Island Wifi is about $120 per month. There is also a 9.99 plan that gives you phone and 1GB of data. This is what we pair with My Island Wifi to give us a local phone number when in the Bahamas. You can check out their site for more options. https://www.btcbahamas.com/explore/mobile/prepaid

Aliv: Aliv is not everywhere in the Bahamas just yet, but if you are in a covered area, it’s a great option. The cost for unlimited internet and calling to US/Can is $140 per month. When we tested it, we found Aliv to have consistently the fastest data throughput of all the competing services. Check out their plans at https://www.bealiv.com/shop/prepaid-plans

Coverage while cruising

Besides the open ocean many miles from land, there were only a few spots we can think of where connectivity was a problem. One is In North Carolina. From Albemarle Sound to Pamlico Sound via Alligator River is pretty much a dead zone. Don’t expect to be doing much web surfing during that passage.

In the Bahamas, the only real dead zone we have encountered is in the Exuma Land and Sea Park. You can get a connection on the fringes of the park, but nothing spectacular. You can also grab a bar or two on BoBo Hill at Warderick Wells, but again, don’t expect to be impressed. We love the park and would spend much more time in it if we had a decent connection. Wonder if we can petition someone to put a cell tower or two throughout the park?

How does this compare to land-based living?

From what we can remember, this is either equal to or cheaper than what we had in our land-based life. We paid $100+ for internet service to our home, along with a cell/data plan for our mobile phone at another $100+.

Transportation

Getting around on land when you are bound by water is getting much easier than it used to be. Bike or scooter rentals are getting much more common. The advent of Uber/Lyft has given most places an easy and affordable guaranteed mode of transport. In the Bahamas, you can count on golf cart rentals or regular car rentals if you are on the bigger islands.

If you are wondering what it might cost to fly in and out of the Bahamas, well we have some good news. Cyndi flew out of Great Exuma Island, it was January, and she got a one-way ticket at short notice for $400 from the Bahamas to Toronto with one stop in Atlanta on Delta and $240 US on the way back. That is pretty cheap. Not sure if the price was due to the time of year or what, but it does let us know that you can get some good flight deals.

How does this compare to land-based living?

Planes, trains, and hotels can probably be compared to a yearly vacation or two which most people take. The rest can be compared to owning a car. Since we already offset the fuel cost of the boat with the car, then we don’t have anything to offset these transportation costs with. However, if you are a 2 car family, then this will more than offset that. A second car would be much much more expensive than these transportation costs.

Marine Insurance

We are with BoatUS/Geico with a Bahamas extension on the policy. They said that the premium cost increase in the second year was due to hurricane Irma the previous year.

Our insurance policy allows us to go as far south as Turks and Caicos, and during hurricane season to be in the US or Bahamas with a good Hurricane plan sent to them. If we were to go further south into the Caribbean, we don’t know how much extra the extension for that would cost us.

It may also be worth noting that before venturing on this journey, we had 20 years of boating experience on the Great Lakes and tributaries. If we did not have this, our insurance premium would have been higher. Some companies will not insure you for this type of voyage if you do not have much experience.

How does this compare to land-based living?

Even in land-based living, we would always have a boat. We can’t imagine life without one. We would be paying some sort of marine insurance anyway. Our policy on our last boat which was used seasonally up north was around $1500. So it is more than double that to head south in a bigger boat.

Marinas & Mooring

Anchoring is our preferred way to spend our days on the water. However, we have found that marinas are required more than we thought they would be. When you run into certain mechanical issues, there is nothing like the security of a marina to accomplish the fixing of said issue. Sometimes, the bad weather is such that a marina makes more sense safety-wise. Also when doing major provisioning. Being at a marina makes loading the boat much more convenient.

There is also the fact that sometimes we just want to stay in a marina. At times, it is convenient to facilitate exploration or take in shore events that may be happening.

How does this compare to land-based living?

If you are one that, like us, would own a boat even if you are living a land-based life, then you will always have marina fees. If seasonal like we would be in Canada, you would have winter storage fees as well. For our 34 foot boat we had previously, we paid $2150 for Winter storage and around $3500 for summer dockage. Though the total of that isn’t the total of the marina and storage costs of our 44 liveaboard, but it’s close.

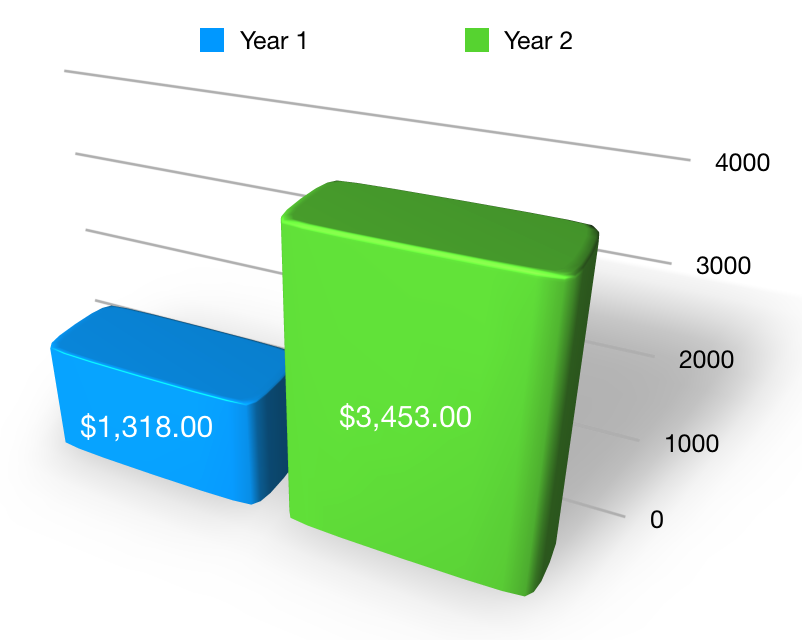

Technology

Besides a used iPad Pro 12.5” that we bought used for $400 that is used to supplement navigation, this category is really not boating or liveaboard lifestyle related. However, we decided to add it in just so you can see what video production may cost if you plan to cruise and do a YouTube Channel, or even if you don’t have a YouTube channel, you might take a lot of video and photos for your friends and family to enjoy on social media.

If there was one video camera that we think every cruiser should have it would be the GoPro, and not just any GoPro the Hero 7 Black or the Hero 8 Black. These cameras have gotten really good. With Hypersmooth video capture and the fact that you can take it underwater with you, makes it the go-to camera for your boating adventures. We picked up a GoPro Hero 7 Black in year 2, and we will be picking up a Hero 8 Black very soon.

Also in year two, we picked up a DJI OSMO Pocket, a DJI Mavic 2 Pro drone, some microphones, and other video production equipment. One of the biggest things in year 2 was the fact that we lost a hard drive with a season worth of video, and it wasn’t backed up. Because of this, we bought a new Network Attached Storage device of 16 TB for $1000, to supplement our existing 12TB NAS that was full. We also spent $1000 on getting the data off that bad drive and transferred onto the new 16TB NAS.

How does this compare to land-based living?

We probably spend much more here than we would if we were on land. Though being techies and loving to take photos and videos I’m sure we would have found an excuse to buy similar equipment. We will call this one about equal.

Diving

We know not everyone dives, however, it is good to see what scuba could add to your expenses should you decide to take it up while cruising. We love it and can see ourselves spending more on this activity in the future. If we ever have a season without a boat, we will likely take a liveaboard dive vacation.

How does this compare to land-based living?

Diving is all extra expense for this lifestyle. We probably wouldn’t be doing scuba diving back in Canada.

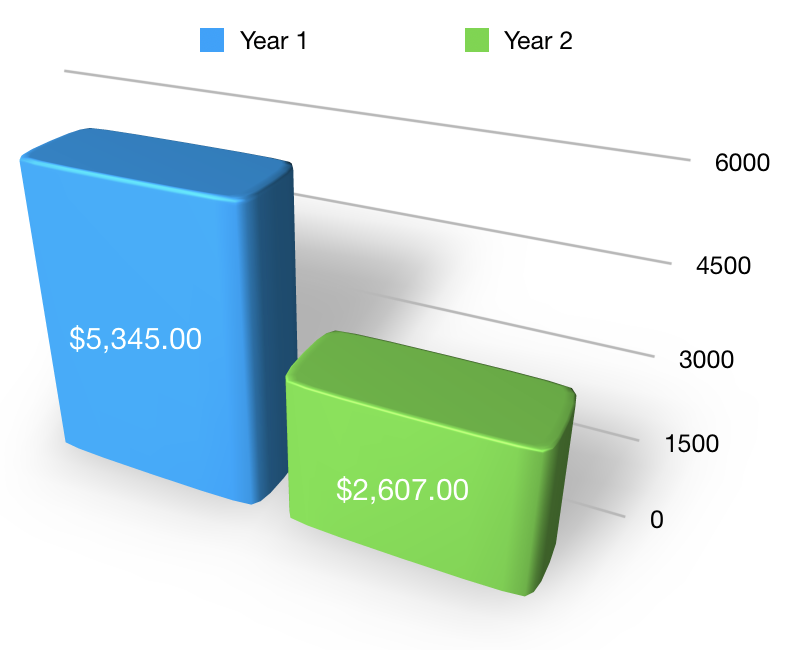

Repairs & Maintenance

This is always the category potential live aboard cruisers worry about the most. The maintenance is predictable enough, it’s the stuff that goes wrong that you had no idea was coming. This is understandable, but the fear is usually misplaced. One’s due diligence here is what you should rely on to curb the fear. A good marine survey before you take possession of the boat, along with a separate engine survey by accredited technicians of the brand of engine you have. Doing regular oil analysis on the engine fluids. Then making sure the engine has been serviced correctly and good records kept. If you have done those things, you have done all you can do. Things will still go wrong, but a well-serviced diesel engine usually doesn’t just break catastrophically.

Let’s define our terms here. We view regular maintenance as any predetermined scheduled maintenance. Things that have to be done every so many hours to keep things running smoothly. Things like oil and filter changes, fuel filter changes, even things like scheduled fuel injector cleaning, or valve adjustments.

Repairs, of course, are the unexpected things that fail as we cruise. Things that may break or fail prematurely, or because of an accident. Things like pump failures in the engine or otherwise, impact damage above or below the water, something blows up, electronics suddenly stop working, and even blowing a head gasket.

Parts are items that we buy as spares, just in case something fails or for future scheduled maintenance. Parts purchased at the moment to repair something unexpected are included in repairs, not parts.

Let’s break down year one’s repair costs. $14,000 Was a direct result of the accident in Hope Town. The largest thing that was not covered under insurance was supplementing the insured paint job with what should be done to make the paint job correct; Bringing the paint down to the edges of the nonskid on the deck, instead of stopping the paint at the cap rail in the aft cockpit. Also painting the blue stripe on the flybridge, since the other blue stripes were getting painted, this would look really faded against the new. Taking the boat apart to prep for paint we noticed that the bow pulpit had enough rotten wood in it that it needed a total rebuild of that wood bracing.

Another thing that bumped the repair costs up that year was the turbos. We pulled into North Carolina to see our trusted mechanic because we noticed an occasional loss of power on the port engine for two days. We didn't narrow down what the problem was, and we didn't notice it again afterward. While in North Carolina, our mechanic noticed that someone jammed engine pencil zincs in a place near the turbos on both engines. They could not be removed without removing the turbos on both engines. They were probably there for a very long time, but if they broke off they would get sucked into the turbos, wrecking them. I didn't want to have the turbos destroyed at an inopportune time or a remote place, so I decided to remove the turbos to get the pencil zincs out. When we removed the turbos, we decided to replace them since there was enough gunk in there that eventually it was going to cause problems. $4000 later we had new turbos and the problem zincs were removed.

To be honest, If we had known what was coming next with the head gasket and fuel injection pump, we would not have fixed the misplaced zincs or turbos but left it all in place. It probably would never have been a problem. When we did the head gasket repair in Freeport and things were put back together, we found the fuel injection pump not working. We replaced that with a rebuilt unit. We are thinking the fuel injection pump may have been the source of the problem we encountered coming into North Carolina.

Though not everyone is going to have an accident like we did, nor blow a head gasket as we did, it is still wise however to have a way to pay for large unexpected repairs. In general though, if we remove the $14000 from the total, then average that over two years, you get just above 10% of the value of the boat. That is sort of the common rule of thumb. Expect to have 10% of the value of the boat in repairs and maintenance per year. Some years it will be over, some it will be under, but for an older boat, we think 10% is a good expectation, especially if you are living aboard and cruising full time.

One thing is for sure, we hope not to have $40000 in repairs and maintenance every year, if we did, we would not be able to afford this lifestyle.

How does this compare to land-based living?

When comparing this to repairing and maintaining a home, we are going to assume if you have a more expensive boat, you will have more expensive maintenance, and you have a more expensive home with more expensive maintenance. For us, The cost of maintaining and repairing our home, along with the equipment to own to maintain it (lawn tractors, snowblowers, etc) was absolutely $10,000 or more a year, but until we go a few more years without any unexpected high repair costs, we are not going to say living aboard is cheaper. It possibly is, we just don’t have enough personal information to make that judgement.

If you are still reading, we hope you enjoyed and got something out of that breakdown. In hindsight, this post may be a bit too long and we probably could have broken it up. Oh well.

We will keep tracking our numbers and hope to make costs update posts in the future. If you have any numbers to share we would love to hear them. We are very curious about the comparison to other cruisers in other types of boats. For example, do newer boats have the same cost ratio for maintenance? Do single engine trawlers experience the same yearly costs? Does a sailboat offer any savings or does rigging cost as much as maintaining an engine? We are still learning, and the learning will never stop.